Trump administration to cover obesity medication

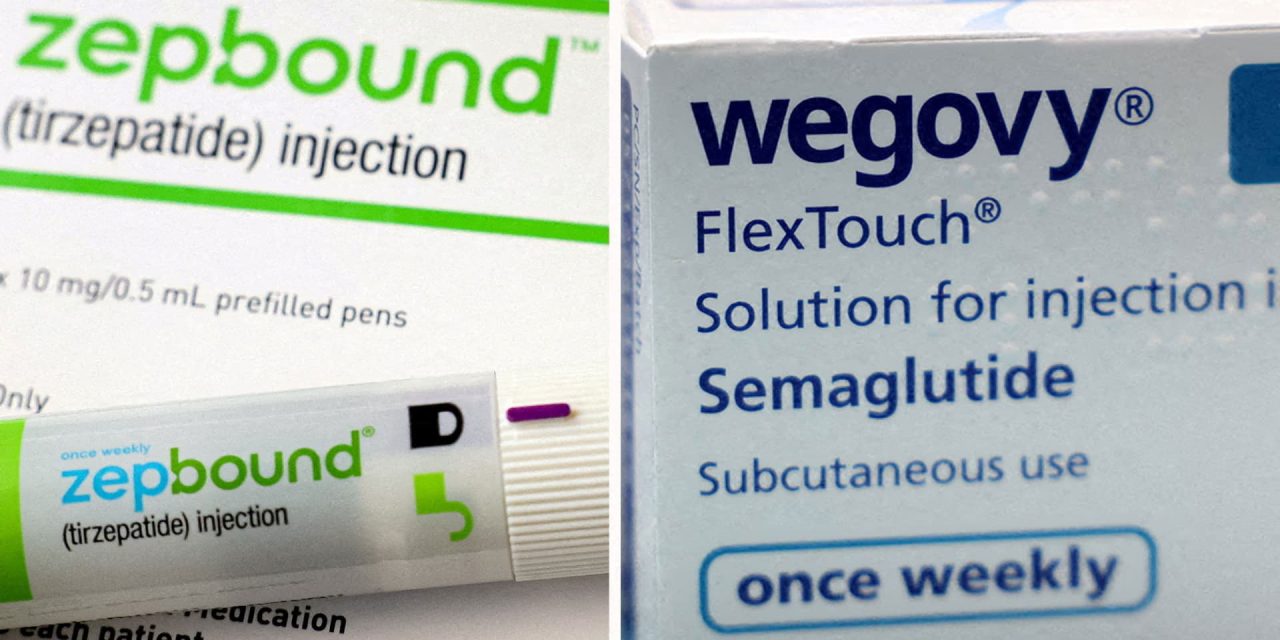

A combination image shows an injection poison from Zepbound, Eli Lilly’s weight loss drug and car from Wegovy, which were made by Novo Nordisk.

Hollie Adams | Reuters

A version of this article was first published in CNBCS Healthy Return’s newsletter, in which the latest health news leads directly to their inbox. Subscribe here to get future expenses.

In exceptional cases, the Trump administration may give some drug manufacturers a reason to celebrate.

The administration of Trump plans to experiment with the coverage of costly weight loss as part of Medicare and Medicaid, reported Washington Post on Friday. This plan could expand access to millions of Americans with obesity that cannot currently afford Novo Nordisk‘s Wegovy and Eli LillyBlockbuster GLP-1 medication that costs around $ 1,000 per month before insurance.

In an explanation of CNBC on the plan, the Department of Health and Human Services said that all drug covers are subjected to a “cost-benefit check”. The centers for Medicare and Medicaid services “Do not comment on potential models or reporting,” added the department.

The registered plan – if it ultimately comes into force – would be a great victory for Eli Lilly, Novo Nordisk and many Americans.

Plained insurance coverage for obesity drugs is still the greatest obstacle to access for patients – and it will be a broader recording and sales growth for the two pharmaceutical giants first tours. Many health plans, including Medicare, cover GLP-1 for the treatment of diabetes, but not to obesity. Medicaid medication is limited and varies according to the KFF organization for health policy.

However, it is important to remember that this plan is not exactly new.

In November, the bidges proposed that Medicare and Medicaid cover obesity treatments that would have extended access to around 3.4 million Medicare -privileged and around 4 million Medicaid recipients. The proposal was controversial at the time because it would cost the taxpayer up to 35 billion US dollars in the next decade, showed an analysis of the congress.

The Trump administration dropped this proposal in April, but said that it could rethink the reporting on these medication in the future.

Let us look in the plans registered by the latest reported iteration.

According to the reported pilot plan of the Trump government, state medical programs and Medicare part D plans could voluntarily choose to cover Ozempic, Wegovy, Mounjaro and Zepbound for “weight management”. This applies to several centers for Medicare and Medicaid services received by the post office.

The plan is expected to begin MedicAid for Medicare plans in April 2026 and January 2027, the post reported.

It is unclear how exactly the plan will play, said Jared Holz, Mazuho Health Care Equity Strategist, in a reference to customers on Friday. Holz said that he expects the government to use some cover parameters in connection with factors such as age, body weight, body mass index and other comorbidities or simultaneous chronic health states.

He also said that the pricing of the drugs would be a “big consideration”. Holz said he expects the government to pay less than the current list prices for drugs. But have that The cover would expand access and could help promote higher sales volumes, as he stated.

Another factor to be taken into account is how much the government is willing to hold up against so-called compound pharmacies, which in rare cases may sell cheaper, non-approved versions of GLP-1S. The pharmaceutical industry is violently opposed to the GLP-1S, since their security and effectiveness of regulatory authorities are not checked and in some cases are illegally sold on a scale.

Holz said that the symptoms of the industry to the government about composed GLP-1S have so far “not been given widespread shutdown”.

Overall, Holz said that the reported willingness of the Trump government to consider the cover of obesity medication was “a little positive for the mood of the industry”.

It is definitely a touch of fresh air for Eli Lilly, Novo Nordisk and other drug makers – including AmgenPresent RochePresent Astrazeneca And Pfizer – they hope to bring their own obesity medication onto the market.

The last six months have been anything but smooth for the broader industry: The Trump administration has included the demands for drug manufacturers to reduce the US drug prices, outdated federal health agencies and could import into the country every day into the country that was imported into the country.

We will continue to see whether this plan will be implemented. So stay up to date on our reporting!

Feel free to send Annikakim.constantino@nbcuni.com tips, suggestions, ideas and data to Annika.

The latest in healthcare: the winning season prompted Medicare Advantage player who changed places

Unitedhealth Group Inc. Signpiece on the bottom of the New York Stock Exchange on April 21, 2025.

Michael Nagle | Bloomberg | Getty pictures

After he was reported on the second income rate and the instructions, Unitedhealth Group Finally, his executive sweep by replacing CFO John Rex. Managers about the winnings admitted to a misunderstanding in Medicare Advantage and promised to return to profitability and regain the investor trust.

It was almost two years ago CVS health After printing, the company of low Medicare Advantage Star.

This week CVS beat and increased its prospects for the strength of his MA program. CEO David Joyner, now a year after the start of the job, told me that he feels good when he turned into Aetna and his medical business. In addition, the company achieved market share profits in its shops, which partly thanked Rite Aid customers.

Humana has recorded progress in his turn in a similar way, but CFO Celeste Mellet told me that all insurers deal with price plans for next year in the middle of high medical costs. A big cost driver at the moment, Mellet told CNBC, are oncological medication because some expensive therapies are now used in combination.

The next moment of truth for the Medicare Advantage players will come in the next six weeks – if you learn the fate of your star reviews for 2026 plans.

Read more from CNBCS Bertha Coombs here.

Latest in the healthcare system Tech: Dr. Marc Harrison changes to a strategic advisory role at General Catalyst

Dr. Marc Harrison in the healthcare sector as CEO of General Catalyst’s Health Assurance Transformation Company (CEO of General Catalyst “(CEO of General Catalyst” (CEO “has changed, CNBC confirmed.

The risk capital company brought in Harrison and announced the foundation of Hatco in 2023. In a release published at that time, General Catalyst said that the company would work closely with partners of the health system and finally acquire and operate their own health system.

Months later, Hatco announced his plans for the purchase of Summa Health, a non -profit integrated health system in the northeast of Ohio. As part of his new structure, Summa would become a non -profit organization, and General Catalyst said that she would introduce new technically capable solutions that aim to make the supply more accessible and affordable.

The purchase of a health system is an unprecedented step in the risko mobile industry, and the deal was not well received by some members of the Ohio community. Hundreds signed a petition in which the sum asked to remain a non -profit organization and to stop negotiations with Hatco.

The Attorney General of Ohio, Dave Yost, approved the deal in June, although he outlined a number of “enforceable obligations” as part of the agreement. Hatco must inform the Attorney General about transactions, which could trigger antitrust concerns 10 years after the deal.

Harrison visited the Medical Faculty at the end of the 1980s and spent most of his career in health systems, most recently as CEO of Intermountain Healthcare. General Catalyst announced CNBC that Harrison would continue to provide the company’s CEO, Hemant Taaneja, clinical knowledge and remains connected to his ecosystem in his new role.

“For Marc and us, it became increasingly clear that Marc’s role as a strategic advisor of Hemant Taneja would best be fulfilled while we bring this ambition and this vision to life,” said a general spokesman for catalyst.

Daryl Tol, head of the Health Assurance Ecosystem of General Catalyst, was promoted to Hatco President, said the spokesman. He will lead the company’s daily work with Summa Health Leadership.

General Catalyst has also appointed Kate Walsh, the former secretary for health and human services from Massachusetts, the Hatco board. In addition, she will act as chairman of the board at Summa Health as soon as the transaction closes.

“We are grateful for the leadership and collaboration of Marc as a co -founder and CEO to get to the development of HATCO to this point, and we look forward to using his invaluable perspective while we continue to progress,” said the spokesman.

Read more about the reporting of CNBC about Hatco’s acquisition of Summa Health.

Feel free to send tips, suggestions, story ideas and data to Ashley at Ashley.capoot@nbcuni.com.